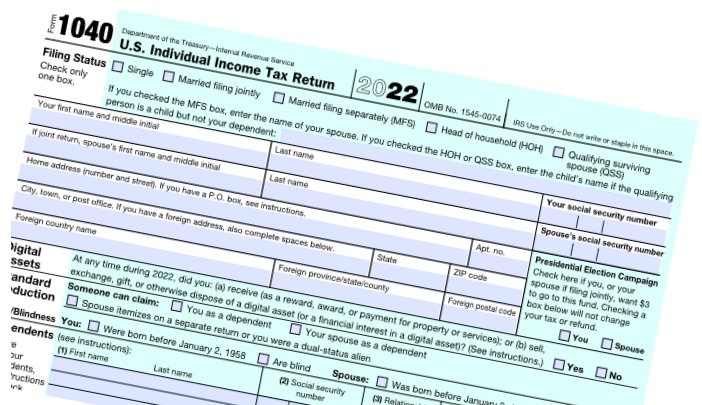

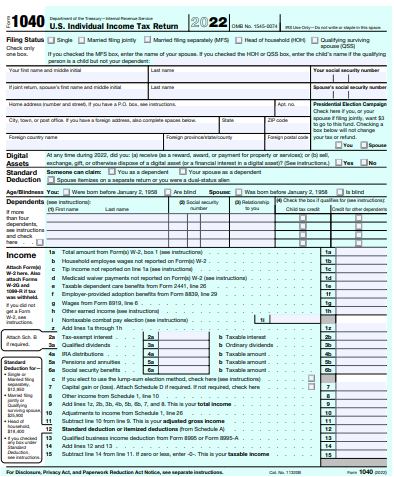

2024 Form 1040 Schedule An Exchange – If you buy, sell or exchange this virtual currency you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment . When it was introduced in 2019, the question was on Schedule 1 of Form 1040, but since many taxpayers was so broad “receive, sell, send, exchange, or otherwise acquire” it potentially .

2024 Form 1040 Schedule An Exchange

Source : www.livenowfox.comTax Season to Start January 29, 2024 CPA Practice Advisor

Source : www.cpapracticeadvisor.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgTax season is under way. Here are some tips to navigate it. | WNCT

Source : www.wnct.comIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

Source : www.bscnursing2022.com2024 Form 1040 ES

Source : www.irs.govAvoid Tax Return Errors & Refund Delays 2024

Source : www.taxpayeradvocate.irs.govIRS to Launch Free E Filing Program in 2024. Here’s What to Know

Source : www.nbcboston.comHow to Fill Out Form 1040 for 2023 | Taxes 2024 | Money Instructor

Source : www.youtube.comGet ready to file in 2024: What’s new and what to consider

Source : www.wlbt.com2024 Form 1040 Schedule An Exchange When will the IRS start accepting tax returns in 2024? When you : The Schedule 1 form is used to report additional income or adjustments to income that are not listed on the standard Form 1040. It includes losses from the sale or exchange of virtual currency . But if you’ve got more things going on in your life, you may also need to get ahold of additional forms, also called schedules, to submit alongside your Form 1040. Schedule A, for example .

]]>